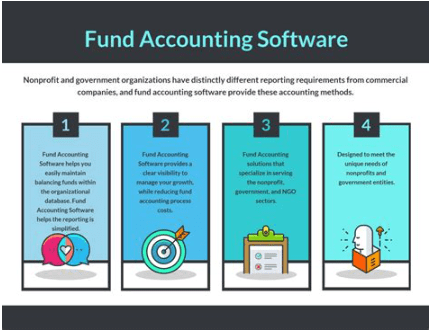

Welcome to our guide on the top fund accounting software to help you efficiently manage your finances. Whether you are a small non-profit organization or a large investment firm, having the right tools to track and report on your financial activities is crucial. With the advancements in technology, there are now numerous software options available to make this process easier and more accurate. In this article, we will take a look at some of the best fund accounting software solutions on the market today.

Benefits of using fund accounting software

Using fund accounting software comes with a multitude of benefits for organizations, both big and small. One of the main advantages is the ability to easily track and manage financial transactions specific to individual funds or grants. This level of detail ensures that organizations can accurately report on the use of funds and comply with any restrictions or regulations that may be in place.

Another key benefit of fund accounting software is the ability to streamline the financial reporting process. By centralizing financial data and automating reporting functions, organizations can save time and resources that would otherwise be spent on manual data entry and report generation. This not only improves efficiency but also reduces the risk of errors in financial reporting.

Furthermore, fund accounting software offers enhanced transparency and visibility into an organization’s financial health. With real-time access to financial data and customizable reporting options, stakeholders can easily track the performance of individual funds, monitor spending trends, and make informed decisions based on up-to-date information. This level of transparency is crucial for maintaining trust and accountability with donors, board members, and other key stakeholders.

In addition, fund accounting software can help organizations better manage their budgets and monitor spending against allocated funds. By setting up budget templates, tracking expenses in real-time, and generating budget vs. actual reports, organizations can proactively identify potential budgetary issues and make adjustments as needed to ensure financial stability.

Lastly, fund accounting software offers robust security features to protect sensitive financial data and ensure compliance with data privacy regulations. By implementing access controls, encryption tools, and audit trails, organizations can safeguard their financial information and prevent unauthorized access or tampering of data. This level of security is essential for protecting the integrity of an organization’s financial records and maintaining the trust of donors and stakeholders.

Key features to look for in fund accounting software

When choosing the best fund accounting software for your organization, there are several key features that you should look for to ensure that you are getting a comprehensive and reliable solution. Below are some of the most important features to consider:

1. Fund Tracking: One of the most important features to look for in fund accounting software is the ability to track funds accurately and efficiently. This includes the ability to track donations, grants, and other sources of funding, as well as monitor expenses and ensure that funds are being used appropriately. Look for software that allows you to easily generate reports on fund balances, budget variances, and other key financial metrics.

2. Customization and flexibility: Another important feature to consider is the customization and flexibility of the software. Different organizations have different accounting needs, so it is important to choose software that can be tailored to meet your specific requirements. Look for software that allows you to customize reports, create custom fields, and easily adapt to changes in regulations or accounting standards. The ability to integrate with other software systems, such as payroll or donor management software, is also important for ensuring a seamless and efficient accounting process.

Additionally, flexibility in terms of user roles and permissions is important for ensuring that the right people have access to the right information. Look for software that allows you to set up different user roles with varying levels of access to sensitive financial data, and that allows you to easily manage permissions and security settings.

3. Compliance and reporting: Fund accounting software should also include features that help you stay compliant with regulations and reporting requirements. Look for software that includes tools for generating financial statements, tax forms, and other compliance documents, as well as features that help you track and report on restricted funds and grants. It is also important to choose software that is regularly updated to reflect changes in regulations and accounting standards, to ensure that your organization remains in compliance at all times.

4. Integration and automation: Integration with other software systems and automation of repetitive tasks can greatly improve the efficiency of your fund accounting process. Look for software that integrates seamlessly with other tools that your organization uses, such as CRM systems or banking software, to ensure that data flows smoothly between systems. Automation of tasks such as invoicing, budgeting, and reconciliation can help reduce errors and save time, allowing your staff to focus on more strategic tasks.

5. Scalability and support: Finally, consider the scalability of the software and the level of support that is available from the vendor. As your organization grows, you will need software that can grow with you and handle increased data volume and complexity. Look for software that is scalable and that offers ongoing support and training to help you make the most of the software. Good customer support is essential for quickly resolving any issues that may arise and ensuring that you are able to fully utilize all the features of the software.

Top fund accounting software for nonprofits

When it comes to managing finances for nonprofits, having the right fund accounting software can make a huge difference. Here are three top fund accounting software options that are specifically designed for nonprofits:

1. QuickBooks Nonprofit: QuickBooks is a well-known accounting software that offers a specialized version for nonprofits. This software is user-friendly and offers features such as donation tracking, grant management, and budgeting tools. QuickBooks Nonprofit also allows for easy customization of reports to meet the specific needs of nonprofit organizations. With its simple interface and robust features, QuickBooks Nonprofit is a popular choice for nonprofits of all sizes.

2. Aplos: Aplos is another top choice for nonprofits looking for fund accounting software. This cloud-based software is designed specifically for churches, nonprofits, and other small organizations. Aplos offers features such as fund accounting, online donation tracking, and customizable financial reports. One of the key benefits of Aplos is its integration with popular fundraising platforms, making it easy to track donations and manage finances in one place. With its affordable pricing and user-friendly interface, Aplos is a great option for nonprofits on a budget.

3. Blackbaud Financial Edge NXT: Blackbaud Financial Edge NXT is a comprehensive fund accounting software solution for nonprofits. This software offers advanced features such as grant management, automated allocations, and budget tracking. With Blackbaud Financial Edge NXT, nonprofits can easily track funds from multiple sources and allocate them to the appropriate programs or projects. The software also offers customizable dashboards and reports, making it easy to monitor financial performance and make informed decisions. While Blackbaud Financial Edge NXT may have a steeper learning curve compared to other options, its powerful features make it an excellent choice for medium to large nonprofits with complex financial needs.

Overall, choosing the right fund accounting software is crucial for the financial health and success of nonprofits. By considering factors such as budget, features, and ease of use, nonprofits can find a software solution that meets their specific needs and helps them effectively manage their finances.

Cost-effective fund accounting software solutions

When it comes to managing funds for your organization, finding a cost-effective solution is essential. Fund accounting software can streamline your financial processes, making it easier to track expenses, monitor budgets, and generate accurate reports. Here are some top tips for finding affordable fund accounting software:

1. Consider your organization’s needs: Before investing in fund accounting software, think about the specific requirements of your organization. Do you need a software that can handle multiple funding sources, track donations, or produce detailed financial statements? By understanding your needs upfront, you can better evaluate which software solutions will be most cost-effective for your organization.

2. Look for cloud-based solutions: Cloud-based fund accounting software is often more affordable than traditional on-premise solutions. With cloud-based software, you can access your financial data from anywhere with an internet connection, reducing the need for costly hardware and IT support. Additionally, many cloud-based solutions offer flexible pricing plans, allowing you to scale your software as your organization grows.

3. Compare pricing options: When researching fund accounting software, be sure to compare pricing options from different vendors. Look for software that offers transparent pricing with no hidden fees or long-term contracts. Some providers offer tiered pricing plans based on the size of your organization or the features you need, allowing you to choose a plan that fits within your budget.

4. Consider open-source software: For organizations with limited budgets, open-source fund accounting software can be a cost-effective solution. Open-source software is developed and maintained by a community of users, making it freely available to download and use. While open-source software may require more technical expertise to implement and customize, it can provide significant cost savings compared to proprietary solutions.

By following these tips, you can find a cost-effective fund accounting software solution that meets the needs of your organization without breaking the bank. With the right software in place, you can streamline your financial processes, minimize errors, and make more informed decisions about your organization’s funding and expenses.

Tips for implementing fund accounting software successfully

Implementing new fund accounting software can be a daunting task, but with the right approach, it can be a smooth and successful process. Here are some tips to help you implement fund accounting software successfully:

1. Plan ahead: Before implementing fund accounting software, make sure to have a clear plan in place. Define your goals, identify key stakeholders, and create a timeline for the implementation process. This will help keep everyone on track and ensure a successful implementation.

2. Get buy-in from key stakeholders: It’s important to get buy-in from key stakeholders, such as board members, staff, and volunteers. Make sure they understand the benefits of the new software and how it will improve efficiency and accuracy in fund accounting.

3. Provide adequate training: One of the keys to a successful implementation is providing adequate training to all users of the software. Make sure to offer training sessions, resources, and support to help users navigate the new system and make the most of its features.

4. Customize the software to fit your organization’s needs: Not all fund accounting software is created equal, so make sure to customize the software to fit your organization’s specific needs. Work with the software provider to set up the chart of accounts, reporting requirements, and any other features that are important to your organization.

5. Test the software before going live: Before fully implementing the new fund accounting software, it’s essential to test the system thoroughly. Set up a test environment and run through various scenarios to make sure the software is functioning correctly and meeting your organization’s needs. This will help identify any issues or areas for improvement before going live.

6. Communicate with staff throughout the process: Communication is key during the implementation process. Keep staff informed about the progress of the implementation, any changes to processes or procedures, and how the new software will impact their day-to-day work. This will help ensure a smooth transition and minimize resistance to the new system.

7. Evaluate and adjust as needed: Once the fund accounting software is implemented, it’s essential to regularly evaluate its performance and make adjustments as needed. Monitor key metrics, gather feedback from users, and make any necessary changes to ensure the software is working effectively for your organization.

By following these tips, you can successfully implement fund accounting software and improve efficiency, accuracy, and transparency in your organization’s financial management.

Originally posted 2025-03-11 10:00:00.